Charge card and credit card are two types of payment methods that allow consumers to make purchases without carrying cash.

Although both of these payment methods offer convenience, there are some key differences between them that consumers should be aware of.

In this article, we will explain the charge card and credit card, and help you understand which option may be best suited for your needs.

What is a Charge Card?

A charge card is a payment method that requires the user to pay the balance in full each month. Unlike credit cards, they do not offer a revolving credit line.

This means that users cannot carry a balance from month to month.

How Does Charge Card Work?

When you make a purchase with these cards, the amount of the purchase is added to your balance.

At the end of the billing cycle, you will receive a statement showing the balance due. You must pay the balance in full by the due date to avoid fees or interest charges.

Advantages of a Charge Card

One advantage of this card is that it can help you avoid debt. Since you are required to pay the balance in full each month, you cannot carry a balance and accrue interest charges.

Additionally, these cards often offer rewards programs and other perks, such as travel benefits or exclusive access to events.

Disadvantages of a Charge Card

One disadvantage of this card is that it may be more difficult to qualify for than a credit card. These cards typically require a higher credit score and income level.

Additionally, if you are unable to pay the balance in full each month, you may incur late fees or other penalties.

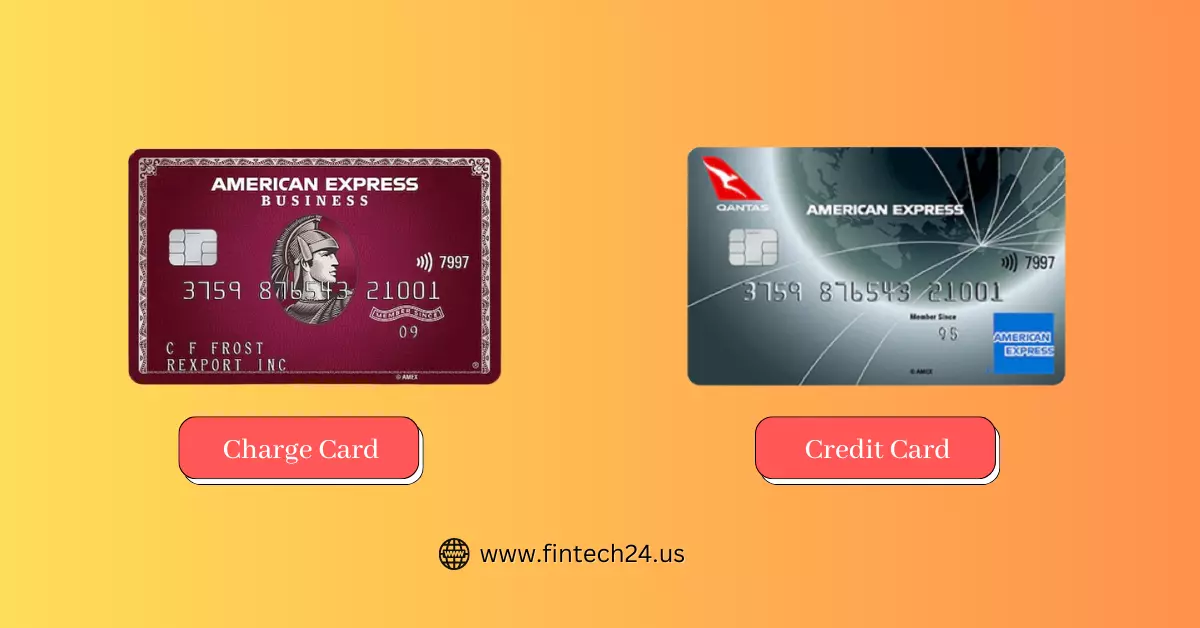

What is a Credit Card?

A credit card is a payment method that offers users a revolving credit line. This means that users can carry a balance from month to month, as long as they make at least the minimum payment due.

How Does a Credit Card Work?

When you make a purchase with a credit card, the amount of the purchase is added to your balance. At the end of the billing cycle, you will receive a statement showing the balance due.

You can choose to pay the balance in full, or make a minimum payment and carry a balance from month to month. If you carry a balance, you will be charged interest on the unpaid portion.

Advantages of a Credit Card

One advantage of a credit card is that it can help you build credit. When you use a credit card responsibly and make payments on time, it can have a positive impact on your credit score.

Additionally, credit cards often offer rewards programs and other perks, such as cash back or points that can be redeemed for travel or merchandise.

Disadvantages of a Credit Card

One disadvantage of a credit card is that it can lead to debt. If you carry a balance from month to month, If you carry a balance from month to month, you will be charged interest on the unpaid portion, which can quickly add up and make it difficult to pay off your debt.

Additionally, credit cards may come with fees, such as annual fees, late fees, or balance transfer fees, that can increase the cost of using the card.

Key Differences: Charge Card and Credit Card

| Charge card | Credit card | |

| Has a preset spending limit | No | Yes |

| Requires you to pay the bill in full each month | Generally yes | No (but you must make at least the minimum payment and watch out for APR) |

| Has late payment fees | Generally yes | Generally yes |

| Has an annual fee | Depends on the card, but generally yes | Depends on the card, but generally yes |

| Has a wide selection of card issuers | No | Yes |

| Holds you responsible for unauthorized transactions | Generally no | Generally no |

The main difference between both card is the requirement to pay the balance in full each month. Charge cards do not offer a revolving credit line and do not allow users to carry a balance from month to month.

Credit cards, on the other hand, do offer a revolving credit line and allow users to carry a balance, as long as they make at least the minimum payment due.

Another key difference between charge card and credit card is the credit requirements. Charge cards typically require a higher credit score and income level than credit cards.

Charge-cards also tend to offer more exclusive benefits and rewards programs, such as access to airport lounges or concierge services.

Which Option is Best Suited for Your Needs?

The option that is best suited for your needs will depend on your individual financial situation and spending habits.

If you are able to pay your balance in full each month and want to avoid accruing debt, a charge-card may be a good option for you.

If you need a revolving credit line and want to build credit, a credit card may be a better fit.

When choosing between a charge card and a credit card, it is important to compare the fees, interest rates, and rewards programs of each option to determine which one offers the most value for your needs.

FAQs

What is the main difference between a charge-card and a credit card?

The main difference between a charge-card and a credit card is the requirement to pay the balance in full each month. Charge-cards do not offer a revolving credit line and do not allow users to carry a balance from month to month. Credit cards, on the other hand, do offer a revolving credit line and allow users to carry a balance, as long as they make at least the minimum payment due.

Can you carry a balance on a charge card?

No, charge-cards do not offer a revolving credit line and do not allow users to carry a balance from month to month. Users must pay the balance in full each month.

What are some popular charge-card options?

Some popular charge-card options include the American Express Platinum Card, the Chase Sapphire Reserve, and the Citi Prestige Card.

What are some popular credit card options?

Some popular credit card options include the Chase Sapphire Preferred, the Capital One Venture Rewards Credit Card, and the Discover it Cash Back.

Is it possible to have both a charge-card and a credit card?

Yes, it is possible to have both a charge-card and a credit card. However, it is important to carefully manage your spending and payments to avoid accruing debt and damaging your credit score.

Final Words: Charge Card vs Credit Card

In conclusion, charge-cards and credit cards are two popular payment methods that offer different benefits and drawbacks.

While charge-cards require users to pay the balance in full each month and do not offer a revolving credit line, they can help users avoid debt and may offer exclusive benefits and rewards programs.

Credit cards, on the other hand, offer a revolving credit line and can help users build credit, but may also lead to debt if not managed responsibly.

By comparing the fees, interest rates, and rewards programs of each option, consumers can choose the option that best fits their financial needs and goals.